This post is going to be about what happens to assets that were not previously disclosed during a California divorce case.

This failure to disclose could be intentional, such as your soon-to-be ex-spouse purposely trying to hide bank accounts and other property from you. For instance, suppose you were a stay-at-home mom and your husband was the one who worked outside the home. Even though all the property the two of you acquired during the marriage is likely going to be community property to which you would be entitled to half, he might view it as all rightfully belonging to him because he was the one who went out to work for it. He might, for example, try to hide it by putting it all under his brother’s name, his elderly mother’s name, etc.

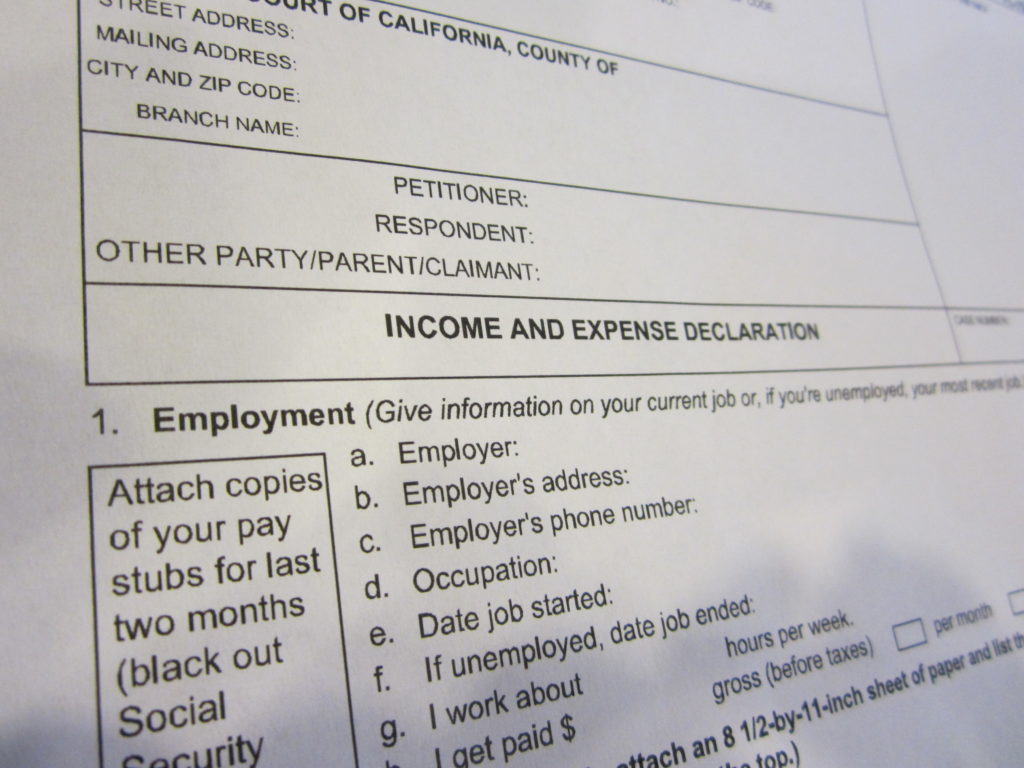

The failure to disclose could also be accidental. People can be forgetful, even when they intend to be honest. Depending on your level of wealth, the length of the marriage, etc, it is possible that your soon-to-be ex-husband, for example, might forget that he had a 401K from a job he worked 20 years ago that he has never touched. Theoretically, all assets and debts should be disclosed during a divorce and each party should — in theory — have total access to all information regarding the couple’s finances. The reality, of course, is never that perfect. The fact that financial disclosure during a California divorce is voluntary and on the honor system doesn’t help either.

Bottom line: if you’re involved in a California divorce and you believe your soon-to-be ex-spouse is trying to hide assets from you, it is unfortunately up to you to somehow prove that.

So what happens when you actually do prove it? The answer is contained within Section 2556 of the California Family Code. The lawyers I know often refer to Section 2556 as the “Omitted Assets” statute. I encourage you to look up the full text of Section 2556 yourself because I am not going to quote it verbatim and there may be details in the actual text that is relevant to your situation. By my read, the main points of Section 2556 are:

- In California divorce, annulment, and legal separation cases, the family court has continuing jurisdiction to award community assets and debts that have not been previously awarded earlier in the case.

- Either party may seek a court order dividing these unawarded assets and debts. The default division of these assets and debts will be 50%-50% to each spouse unless the court finds good cause to divide the assets and debts unequally.

As you can see, Section 2556 applies to assets (e.g. a bank account with $50,000 of community property money in it) as well as to debts (e.g. a credit card with a community property balance of $50,000 on it). You may want to get your share of the community asset, but doing so could also expose you to a bunch of community debt too that you’re currently not shouldering.

As always, this post is not intended to be anywhere close to a comprehensive explanation of section 2556. If you are outside of California or your case has nothing to do with California, then what I have said here about Section 2556 likely won’t apply to you. What should apply to you is this: in general, the best course of action is to find a lawyer in your area to consult with.

Andy Chen

Latest posts by Andy Chen (see all)

- Management of a California Limited Liability Company (LLC) - July 8, 2025

- Record-keeping for a California Limited Liability Company (LLC) - July 7, 2025

- Member Classes in a California Limited Liability Company (LLC) - July 6, 2025