by Andy Chen | Apr 21, 2019 | California, Law, in real life

I’ve never bought a new vehicle in any state other than California. I’m guessing this happens in other states too, but the way it works in California is that you won’t get your actual metal license plates from the California Department of Motor Vehicles until several weeks after you actually drive your vehicle home from the dealership. It used to be that during this time, the only license plate you would have is a paper license plate that usually just had the name and logo of the dealership on it for advertising purposes. Once you got your metal license plates in the mail, you’d install them and throw your paper dealership license plates away. As you can probably guess, having no way to uniquely identify a vehicle for several weeks caused problems. There was no way to catch drivers who would evade automated toll systems at bridge crossings, for instance. FasTrak is a common system in California while in the Midwestern US and East Coast, E-ZPass is more common. Drivers of new vehicles could avoid parking tickets too. It was difficult to track vehicles used in crimes (e.g. bank robberies) as well. If you live in California, you may have noticed that starting in 2019, new vehicles started coming from the dealership with temporary license plates that look like this one. Instead of a paper plate that just had the dealership’s name and logo on it, the new temporary license plate comes with a unique identifying number that is assigned to that particular vehicle until the metal permanent license plate arrives. The reason behind this change is — not...

by Andy Chen | Apr 10, 2019 | California

In a prior post, I went over how it’s possible in California to use a newspaper ad to serve a defendant in a lawsuit who either can’t be found or purposely does not want to be found. Serving a defendant by publication in this way is the exception rather than the norm. Today, I’m going to go over another service method which usually isn’t the norm, but really should be: Service by Acknowledgment. The applicable statute in California is Code of Civil Procedure section 415.30(a). “Service by Acknowledgment” is a fancy of way of saying that the summons and complaint in the case is simply mailed to the Defendant along with a form (called the “Acknowledgment”) that the Defendant then signs and mails back to the Plaintiff. The fact that the Defendant signs and mails it back is the proof that the Defendant was served. The benefit of the Service by Acknowledgment method should be obvious: it’s extremely cheap and simple. All it takes is the cost of postage and the Defendant’s cooperation. In comparison, the cost of hiring a process server to locate and serve a defendant would almost certainly be more, especially if the process server has to make multiple attempts. For these reasons, I generally try to use Service by Acknowledgment whenever possible. In California, there are standard Acknowledgment forms. For California family law cases, the Acknowledgement is California Judicial Council Form FL-117. For regular civil cases (e.g. breach of contract, personal injury, etc) in California, the Acknowledgment is Judicial Council Form POS-015. Two points to know about Service by Acknowledgment under CCP section 415.30: The...

by Andy Chen | Mar 12, 2019 | California

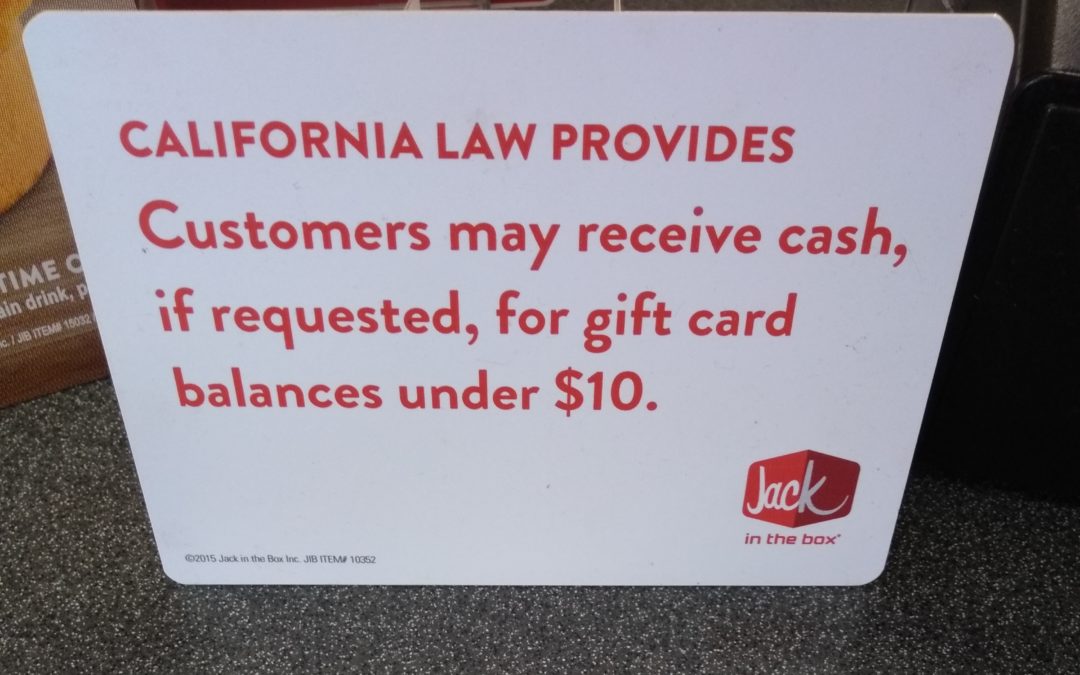

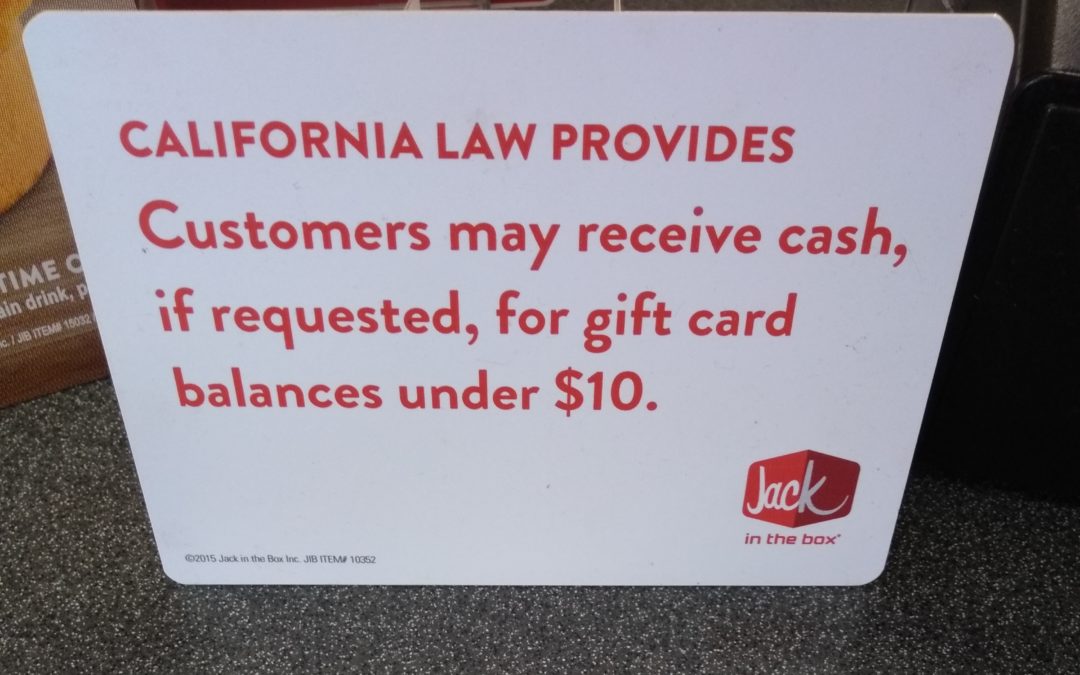

I was on a road trip recently through the Central Valley of California and stopped in at a Jack In the Box. I forgot where I was heading, but I’m fairly certain it was early morning because I remember ordering a most excellent breakfast burrito along with an absolutely terrible cup of coffee. Burritos and coffee aside, though, I cam across this sign while waiting for my order. Because I’m me, I snapped a photo of it to aid in discussing it with all of you. The California law the sign is citing to is the CA Civil Code and it’s specifically section 1749.5(b)(2) which states that, as of January 1, 2008 ” Notwithstanding paragraph (1), any gift certificate with a cash value of less than ten dollars ($10) is redeemable in cash for its cash value.” Paragraph (1) of CA Civil Code section 1749.5(b) further states that ” Any gift certificate sold after January 1, 1997, is redeemable in cash for its cash value, or subject to replacement with a new gift certificate at no cost to the purchaser or holder.“ CA Civil Code section 1749.45(a) defines “gift certificate” to include gift cards as, I believe, most people would normally interpret the term (i.e. a card issued by and usable at a single merchant or retailer). However, section 1749.45(a)‘s definition of “gift certificate” excludes those gift cards “usable with multiple sellers of goods or services” provided that any applicable expiration date is printed on the card. I rarely use gift cards so these multiple seller cards didn’t ring a bell. Sure enough, though, the very next time I was at the grocery store, what do I see but this: Section 1749.5 also goes over the...

by Andy Chen | Mar 10, 2019 | California

If you live in California and you’re a US citizen, having to serve on a jury is a fact of life. Sooner or later, you’ll have to do it. Technically, registering to vote doesn’t increase your chance of getting called for jury duty. However, the last 2 times I’ve been called for jury duty have — by pure coincidence, I’m sure — been right after I moved to a different county and updated my voter registration. This post is going to go over some of the applicable law in California when it comes to serving on a state jury (e.g. in Superior Court in California). The post will go over some of my own experience serving on a state jury. I have not yet served on a federal jury before so I’m not going to cover that. Jurors in California state court do get paid for their time when they serve, but it’s a paltry $15.00 per day (see CA Code of Civil Procedure section 215(a)) and it only begins on the second day that they serve. This $15 rate hasn’t changed since 2004. In addition to the pay, jurors are also reimbursed for the miles they drive to and from the courthouse, but that’s only at 34 cents per mile starting on the second day (see CA Code of Civil Procedure section 215(c)). To compare, the IRS reimbursement rate for miles driven was 54.5 cents for 2018. The $15 per day pay poses an obvious problem to two categories of jurors: (1) those living paycheck-to-paycheck, and (2) those who aren’t living paycheck-to-paycheck, but nonetheless still can’t afford to...

by Andy Chen | Feb 20, 2019 | California

A very common question I encounter is some variant of ‘How do I file a lawsuit against a person if I don’t know where they are?’ I often see this from people who want to file for divorce (in California, divorces must be done in court so a lawsuit must be filed) because they want to get married again and don’t want to commit bigamy. This concern exists these people never got a divorce to end their prior marriage. They simply moved out (or their spouse moved out) and each went on with their lives. Sometimes a year or two passes before the idea of wanting to get married to someone else pops up, but sometimes 10 or more years might have passed and, for instance, people move far away or pass away. In such a situation then, how can this person file a divorce case against their spouse if they haven’t seen their spouse for years? Once filed, the divorce papers have to be served on the spouse and that involves finding the spouse. Somehow. The answer to that question is to do Service by Publication. You might have more commonly heard this described as ‘taking out a newspaper ad’. Most newspapers will have a section where legal notices are posted although it is debatable who or how many people actually look at those ads. I’ve used a divorce scenario to illustrate a situation where service may need to be done via a newspaper ad, but the idea of doing Service by Publication is applicable in California, at least, to a variety of civil lawsuits where serving the...

by Andy Chen | Feb 15, 2019 | California, Employment

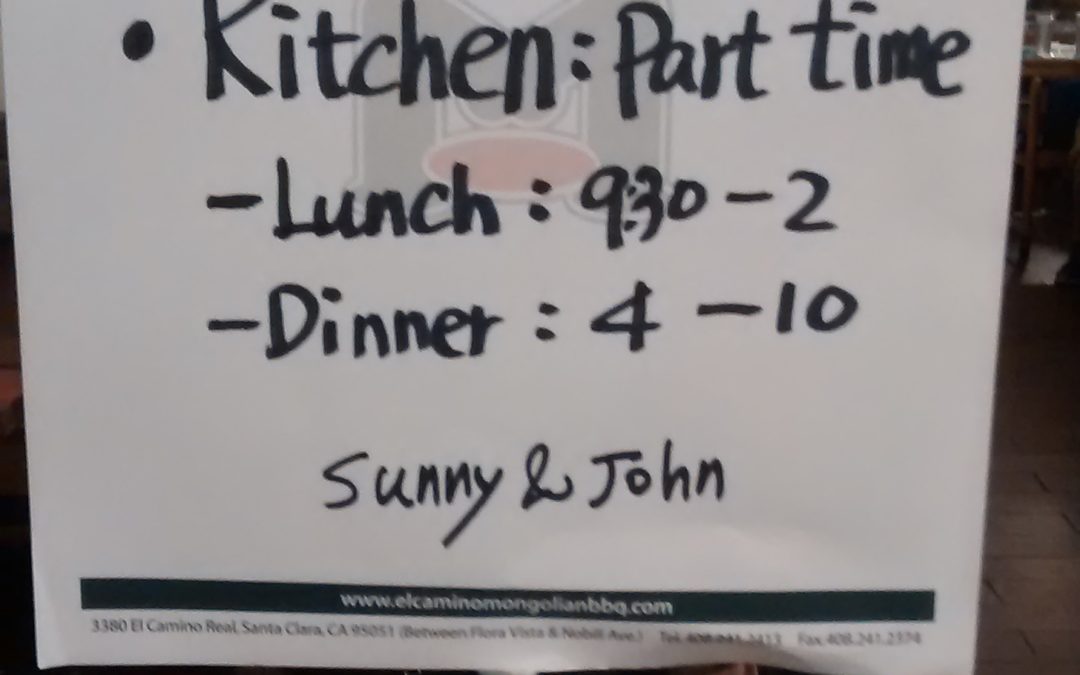

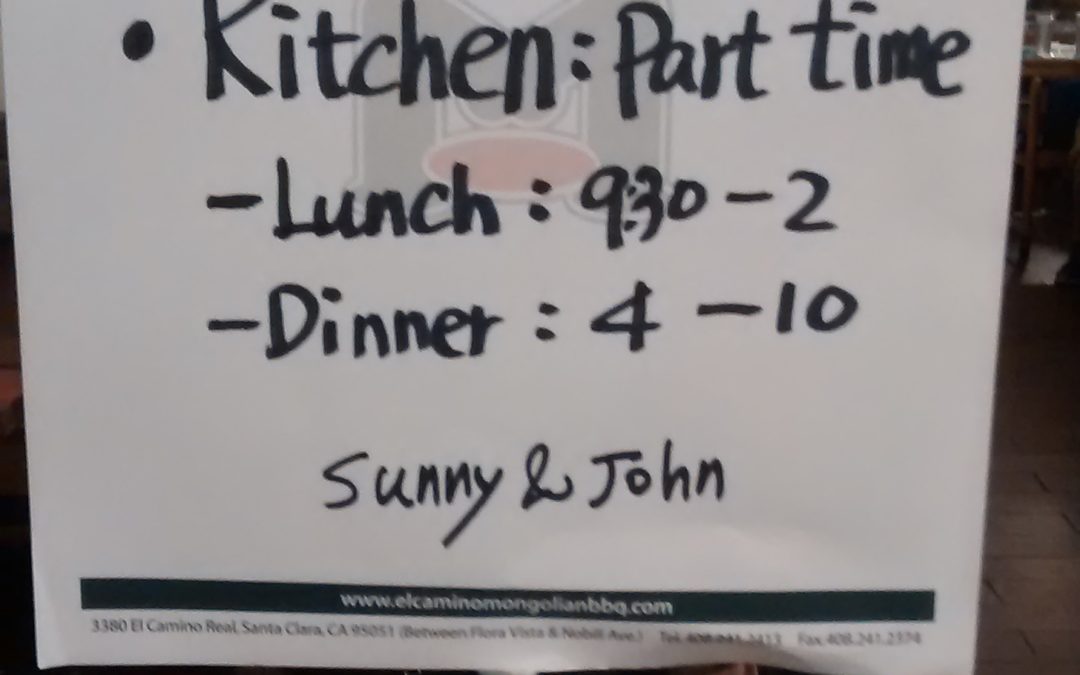

One of my favorite places to go eat in the San Jose area is El Camino Mongolian BBQ. If you’re ever in the Santa Clara, CA area, stop on in. You can mention my name, if you want. (It likely won’t help you, but you can always mention my name. Ahahahahaha… okay, moving on). I was at El Camino Mongolian BBQ recently and snapped the above photo. The owners (Sunny and John) were hiring for kitchen staff. The subject of this blog post is going to be the two time ranges listed for the Kitchen help. If you’ve ever been to a restaurant — and I’m going to assume everyone reading this has — then it shouldn’t be a surprise to you that restaurant workers don’t work a normal 8 hour day. There’s a wave of people for breakfast (assuming the place offers breakfast) and then another wave for lunch and then another wave for dinner. It’s not uncommon for restaurants to shut down in the mid-afternoon (e.g. 3 PM to 5 PM) in between lunch and dinner. In California, a schedule involving a shut down period like this is called a Split Shift. Depending on their hourly wage, an employee may be entitled to additional compensation if they have to work a Split Shift. The governing law here is actually not going to be in a statute (e.g. California Labor Code) or a case, but rather it’s going to be in California regulations. These regulations are codified in Title 8 of the California Code of Regulations from sections 11010 to 11170. If you see references such as “8...