One of my favorite places to go eat in the San Jose area is El Camino Mongolian BBQ. If you’re ever in the Santa Clara, CA area, stop on in. You can mention my name, if you want. (It likely won’t help you, but you can always mention my name. Ahahahahaha… okay, moving on).

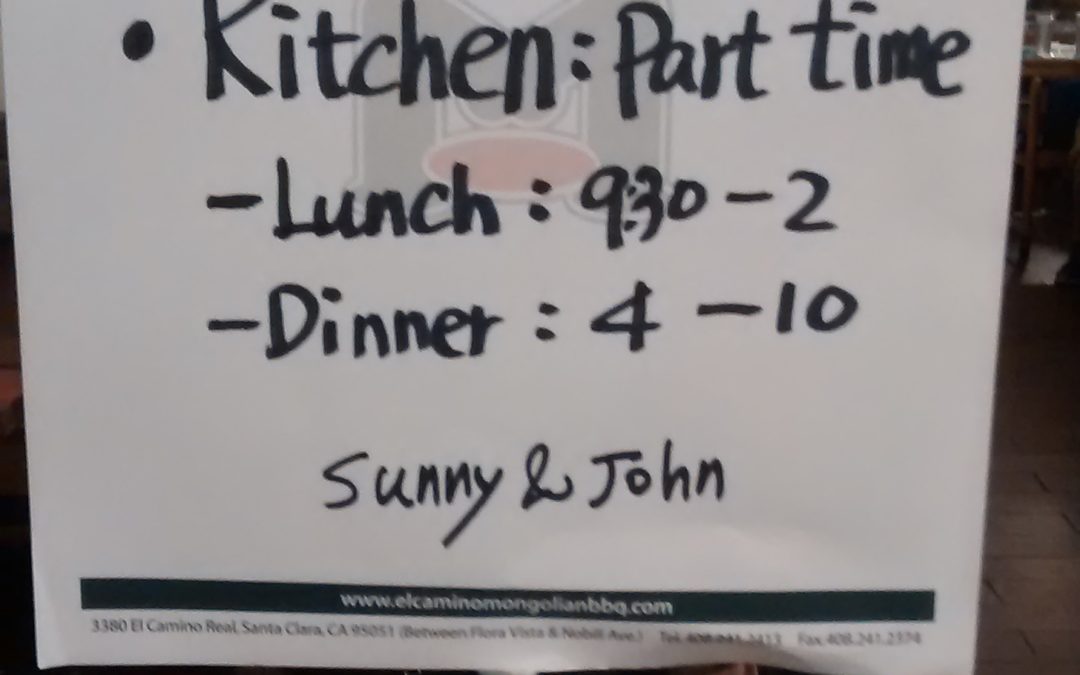

I was at El Camino Mongolian BBQ recently and snapped the above photo. The owners (Sunny and John) were hiring for kitchen staff. The subject of this blog post is going to be the two time ranges listed for the Kitchen help.

If you’ve ever been to a restaurant — and I’m going to assume everyone reading this has — then it shouldn’t be a surprise to you that restaurant workers don’t work a normal 8 hour day. There’s a wave of people for breakfast (assuming the place offers breakfast) and then another wave for lunch and then another wave for dinner. It’s not uncommon for restaurants to shut down in the mid-afternoon (e.g. 3 PM to 5 PM) in between lunch and dinner.

In California, a schedule involving a shut down period like this is called a Split Shift. Depending on their hourly wage, an employee may be entitled to additional compensation if they have to work a Split Shift. The governing law here is actually not going to be in a statute (e.g. California Labor Code) or a case, but rather it’s going to be in California regulations. These regulations are codified in Title 8 of the California Code of Regulations from sections 11010 to 11170. If you see references such as “8 CCR 11010”, that’s where it comes from.

An easier source for the average employee to find out about what Split Shift rules apply to them is probably going to be to look at their Wage Orders. These are freely downloadable as PDFs in multiple languages. There are several Wage Orders and you have to find the one most applicable to your industry. In case it helps, I put out a video on my Youtube channel in 2017 going over California Wage Orders. Here it is.

I’ll go over the general math, though, because I think it’s informative. If you’re wondering about what Split Shift rules apply to you, though, you really should look up the particular Wage Order that applies to your industry.

- Split Shift premium is generally computed relative to an employee making the applicable minimum wage for that area. The way I think about Split Shift premium is that the employer’s liability to any employee who works a Split Shift is what that employer would pay to an employee making the applicable minimum wage who also works that same Split Shift.

- “Applicable minimum wage” as I use the term refers to the minimum wage that actually applies to that particular situation. California has a state minimum wage depending on how employees your employer has, but many cities and counties in California have minimum wages higher that are higher than the state minimum. If your particular employer is in such a city or county, a minimum wage higher than the CA state minimum will apply.

- For instance, suppose an employee makes the applicable minimum wage (say, $13 per hour) for that city or county and works for 8 hours, but there is down time of 2 hours in the afternoon from 3 PM to 5 PM. This employee might work at a restaurant and the restaurant is closed from 3 to 5 PM in between lunch and dinner. The Split Shift premium for such an employee is one additional hour at the applicable minimum wage. Thus, instead of getting $104 ($13 *8) for a day’s work, the employee gets $117 ($104 + $13 Split Shift premium) for a day’s work. These numbers are pre-tax, of course. This 9th hour of pay does not count as over time.

- Let’s change the situation slightly. Suppose it’s the same employer and the applicable minimum wage is still $13 per hour, except this time the employee makes $15 per hour. The employee still works the same 8 hour day and the restaurant is still closed from 3 to 5 PM each afternoon. For an 8 hour day, this employee now earns $15 * 8, or $120. However, because $120 is more than $117, the employee in this scenario doesn’t get a Split Shift premium. The employee needs to receive at least what an employee getting minimum wage in that same Split Shift scenario would receive (i.e. $117) and that employee has received that and more already ($3 more, to be precise).

I hope that helped. The math here isn’t any more complicated than multiplication and division, but it is still math. With employment law cases involving pay, this type of math is, unfortunately, inevitable. Even if you’re really good at math, it might be helpful to lay it out in Microsoft Excel to help compare scenarios. I do that often and I know many other lawyers who do also.

As always, this blog post is not meant to be a comprehensive discussion on the topic and is intended to only give a general overview. If you, for instance, want to know what Split Shift premium is, how it might apply to you, etc, hopefully this post and the resources linked in it were useful.

Andy Chen

Latest posts by Andy Chen (see all)

- Management of a California Limited Liability Company (LLC) - July 8, 2025

- Record-keeping for a California Limited Liability Company (LLC) - July 7, 2025

- Member Classes in a California Limited Liability Company (LLC) - July 6, 2025